It's Not Too Late to Donate!

Donate up to the day you file your 2023 taxes (by April 15th) and you may be eligible to receive a 2023 Ohio tax credit.

CISE-SGO allows you to receive a dollar-for-dollar tax credit and contribute to a brighter future for children in Cincinnati’s underserved communities and .

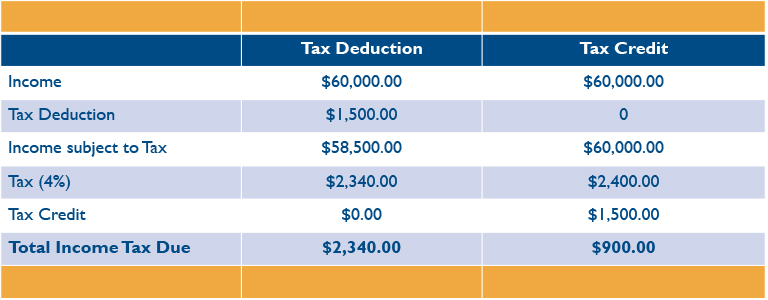

That means if you donate $50, you receive $50 credit towards your Ohio state income tax liability.

What is an SGO?

CISE-SGO is an accredited 501(c)3 and has been certified by Ohio as a Scholarship Granting Organization.

SGOs provide a tax credit that allows Ohio residents to receive a reduction in their state taxes when they donate to a certified SGO.

100% Tax Credit

Individuals can contribute up to $750 (or $1500 for married couples filing jointly) and receive an Ohio tax credit for the same amount as their contribution.

You can make a real impact on a child’s education and receive a significant reduction in your tax liability at the same time.

Transform Lives

Research shows that education is the key to breaking the cycle of poverty.

Your donation provides students in our inner-city communities the educational opportunities and vital support services they need and deserve. Your support opens doors to brighter futures.

SGO Donations at Work in Price Hill

A Brighter Future for Students with Learning Differences – St. Lawrence & OptimALL

In the heart of Price Hill lies St. Lawrence Elementary School, a safe and inclusive Catholic school serving students in Cincinnati’s inner-city. It’s the kind of school every parent would like for their child to attend. When you step through its doors, you’re immediately welcomed into a warm, friendly environment, where colorful student artwork adorns the walls.

But the transformation happening here runs deeper than what meets the eye. This transformation is not only reshaping the lives of students; it’s a testament to the power of collaborative partnerships. This year, St. Lawrence introduced OptimALL, an intervention program which brings crucial educational support to students with diverse learning needs. This transformative program is made possible by generous donations to CISE-SGO (Scholarship Granting Organization).

“I hope CISE donors know how grateful I am for the impact they have made in my children’s lives. They made an investment in my children’s future, and I want them to know that my children will carry that investment forward and make a difference in the lives of other people and make the world a better place, each in their own unique way.“

– Ebony Webb, Parent of 5 CISE Students

Make A Difference. Donate Today.